by questful | Aug 16, 2023 | Legal, Uncategorized

Do want to file a joint divorce with your spouse, but you’re not sure where to start? In this article, I’ll guide you through the next steps you should take. Filing as Co-Petitioners means that both you and your spouse will sign the Petition for Dissolution. While...

by questful | Mar 19, 2023 | Financial, Uncategorized

Going through a divorce can be an emotionally and financially stressful experience. Dividing assets and liabilities, including the family home, can be a complex and challenging process. This is where a divorce mortgage expert can play a crucial role in helping you...

by questful | Nov 1, 2021 | Legal, Uncategorized

Collaborative divorce is focused on minimizing the harmful effects of divorce on families by helping you reach respectful solutions tailored to your family. If you are ultimately unable to resolve your divorce by reaching agreements, you’ll end up in trial with a...

by questful | Oct 9, 2021 | Financial, Uncategorized

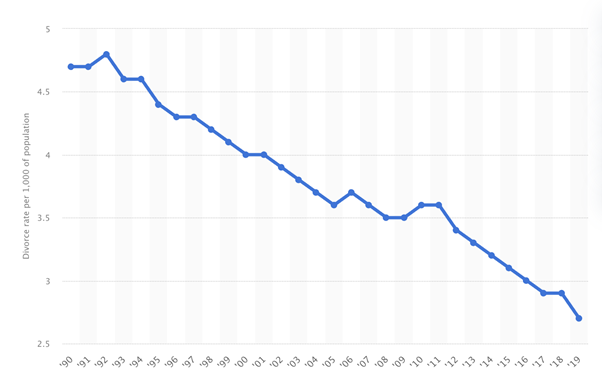

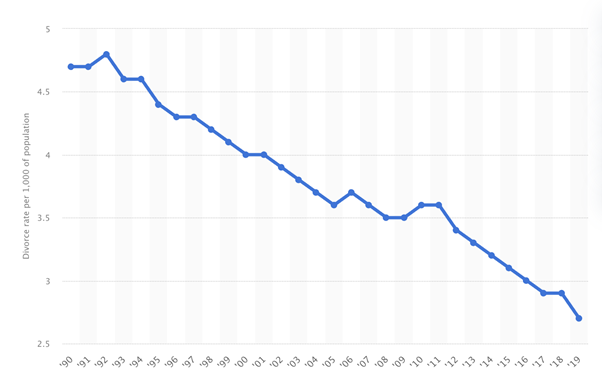

Over the course of the last few years, the divorce rate in the United States has been declining exponentially. Data fetched from Statista indicates that the divorce rate in the United States stood at about 2.7 per 1,000 of the overall population. Despite this...

by questful | Mar 15, 2021 | Legal

Unbundled legal services (also known as limited representation) can be a cost-effective way to obtain advice from an attorney without full representation in court. This type of representation provides the client with some control over the costs of litigation because...