by questful | Nov 24, 2024 | Financial, Uncategorized

Divorce often brings emotional and financial challenges that can feel overwhelming, especially when informal agreements exist between spouses. Regardless of any pre-existing arrangements, financial disclosures during divorce are vital for ensuring transparency and...

by questful | Dec 10, 2023 | Financial, Uncategorized

Divorce involves complex decisions regarding the marital home and real property. Agreeing on how to handle the mortgage and the family home can be a challenging aspect of this process. The options available to divorcing homeowners depend on several factors, including...

by questful | Dec 10, 2023 | Financial, Uncategorized

Unlike most the traditional separation process, the collaborative approach with divorce includes a financial neutral that usually holds the designation of Certified Divorce Financial Analyst (CDFA). The support that the financial neutral provides is helpful with...

by questful | Dec 10, 2023 | Financial, Uncategorized

Divorce is a tumultuous life event, and when intertwined with financial decisions such as refinancing, it can add a layer of intricacy to an already complex situation. Typically, individuals refinance their homes to secure lower interest rates and reduce costs, but...

by questful | Mar 19, 2023 | Financial, Uncategorized

Going through a divorce can be an emotionally and financially stressful experience. Dividing assets and liabilities, including the family home, can be a complex and challenging process. This is where a divorce mortgage expert can play a crucial role in helping you...

by questful | Oct 9, 2021 | Financial, Uncategorized

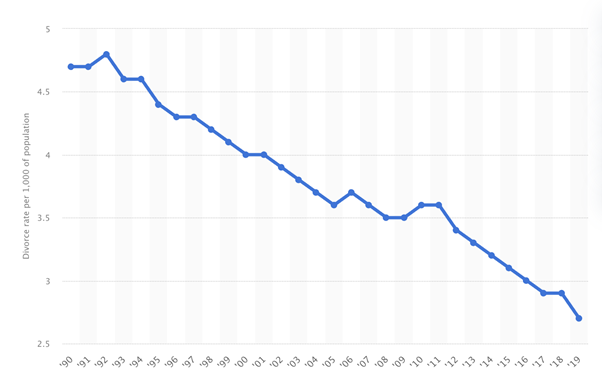

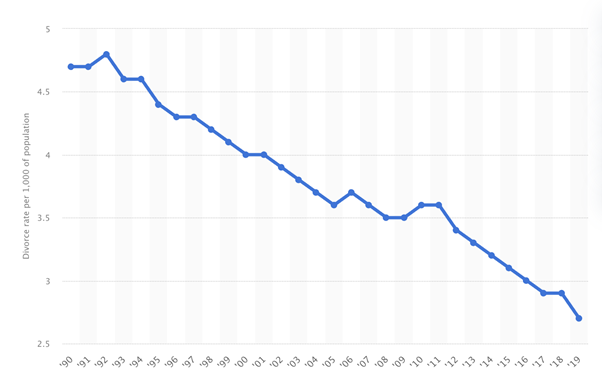

Over the course of the last few years, the divorce rate in the United States has been declining exponentially. Data fetched from Statista indicates that the divorce rate in the United States stood at about 2.7 per 1,000 of the overall population. Despite this...