by questful | Oct 9, 2021 | Financial, Uncategorized

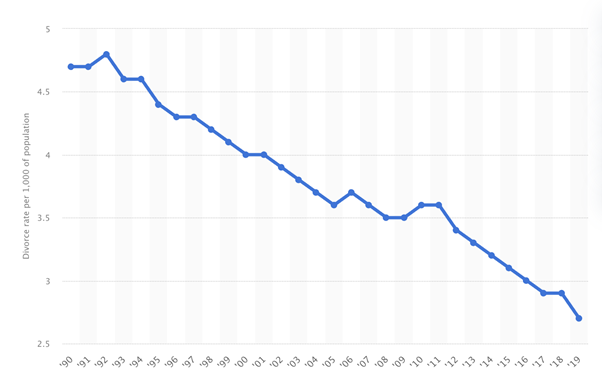

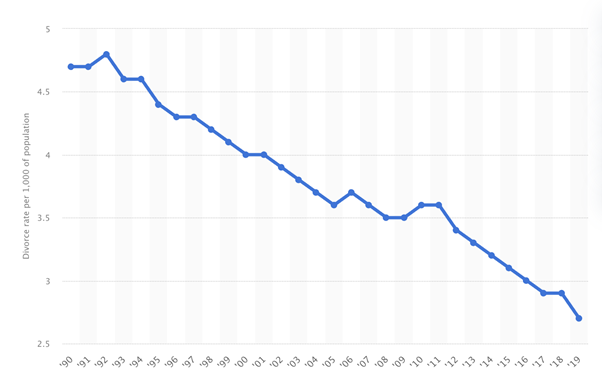

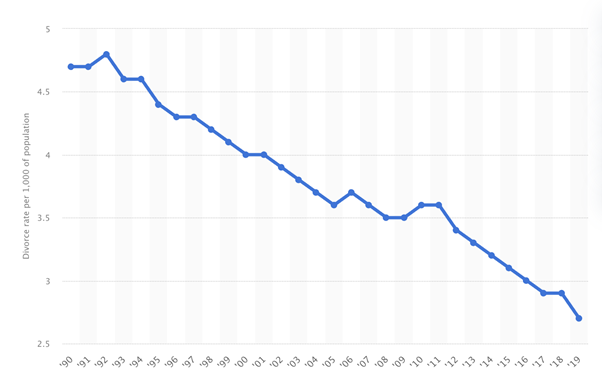

Over the course of the last few years, the divorce rate in the United States has been declining exponentially. Data fetched from Statista indicates that the divorce rate in the United States stood at about 2.7 per 1,000 of the overall population. Despite this...

by questful | Sep 5, 2020 | Financial, Uncategorized

You’ve been awarded the marital home through the negotiation process. What’s next? You’ll want to speak with a mortgage professional who specializes in divorce. Qualifying to Refinance You will need to qualify for the new loan using only your income and assets. You’ll...

by questful | Jul 28, 2020 | Collaborative Law, Uncategorized

Contemplating divorce can be one of the biggest life-time decisions you will ever make. Deciding how you get through the process can have a tremendous impact on how life after divorce will affect you emotionally and financially. The common approach in our culture...

by questful | Jul 28, 2020 | Financial, Uncategorized

Determining the value of your home for a fair assessment can sometimes be difficult. Often the disposition of the marital home can become cantankerous as well. There are ways to obtain a fair and partial appraised value when going through divorce. An appraiser can be...

by questful | Jul 28, 2020 | Financial, Uncategorized

Moving home is a significant undertaking at any time, but when you are also going through a divorce there can be some additional issues to consider. Many couples will need to sell property during a divorce so it is important to think about how you will manage this...

by questful | Oct 23, 2019 | Parenting, Uncategorized

Parents who are experiencing divorce, separation or a breakup will need to develop a formal parenting plan. One of the most important components of a thorough, useful and enforceable parenting plan is a parenting time schedule that considers your family’s needs and...